Financially Preparing for Your Mortgage: A Comprehensive Guide

Kari Cooper

Buying a house – it sounds exciting, right? But then you come across complicated terms like "credit score" and "debt-to-income ratio" that leave you feeling confused. Fear not, this chapter is your guide to understanding the financial aspects.

We'll break down the scary stuff, like credit scores and debt, so you can understand what lenders are looking for.

Plus, we'll share tips to help you feel like a financial expert, ready to reach your goals with confidence.

Skip to:

Credit Score

Debt to Income Ratio

Loan To Value

Savings

Credit Score

Your credit score shows how you've handled borrowing in the past. It's crucial for lenders to decide if you're a reliable borrower. Here's why it matters:

- Interest Rates: A higher credit score means lower interest rates on your mortgage. This saves you money over time.

- Loan Approval: A good credit score increases your chances of getting approved for a mortgage with better terms.

What is a Good Credit Score?

Tips on Improving your Credit Score

- On-time payment is the best thing you can do for your credit!

- Don't max out your credit cards! Keep balances low – it's like showing self-control to your credit score.

- Credit cards can be your friend! Use them wisely, pay them off in full

- Fight the good fight! Challenge mistakes on your credit report – it's like fixing a typo on a test.

- No card shopping spree! Apply wisely – each application can lower your score.

- Keep those aged accounts open! Even inactive ones can boost your score – like a long history of responsible credit use.

Loan Options for Bad Credit Score

Shop around for lenders! Different ones have different requirements, so compare and find the best fit. The good news? Even with less-than-perfect credit, you have options:

1.Secured Loans

These loans require you to pledge an asset, like a car or savings account, as collateral. This reduces the lender's risk, potentially leading to better interest rates and approval chances.

2.Co-signer

Partnering with someone who has a strong credit history can boost your credibility with lenders. Just remember, both parties are equally responsible for the loan.

3.Government Loans (USA)

Programs like FHA (Federal Housing Administration) and VA (Veterans Affairs) loans are designed to assist homebuyers with less-than-ideal credit scores. They often have more flexible requirements and lower down payment options compared to conventional loans.

FHA and VA Mortgage Loans: What You Need to Know

4. Specialized Lenders.

Some lenders specialize in loans for individuals with imperfect credit. Be cautious of higher interest rates but explore these options for potential flexibility.

Discover your best loan opportunities with ACM's personalized financing options. Contact Us Today.

Key Takeaways

- Credit score matters: It impacts mortgage interest rates and approval chances. Aim for 670 or above for the best deals.

- Improve your score: Pay bills on time, manage credit cards wisely, and dispute errors on your report.

- Loan options for all: Secured loans, co-signers, government loans, credit unions, and online lenders offer options for various credit situations.

FAQs

Q) Does PayPal Credit affect credit score?

A) Yes, PayPal Credit impacts your credit score based on payments. Timely payments help improve it, while missed payments can lower it.

Q) Does late rent affect credit score?

A) Late rent payments typically don't affect credit scores unless reported to credit bureaus by your landlord.

Q) Does switching banks affect credit score?

A) Switching banks generally doesn't affect your credit score directly. However, opening new accounts or applying for credit can impact it temporarily.

Q) Is 680 a good credit score?

A) A credit score of 680 is generally considered a good credit score. With a 680 credit score, you may qualify for better rates and terms compared to someone with a lower score.

Q) Does a car accident affect your credit score?

A) Car accidents don't affect credit scores directly. However, unpaid bills related to accidents could affect your credit if they go to collections.

Q) Calculate: impact of credit score on loans

A) Your credit score influences loan terms significantly. Higher scores can qualify you for lower interest rates and better loan options, saving you money over time.

Debt to Income Ratio

Your debt-to-income ratio (DTI) shows how much of your income goes to existing debts. It's crucial for mortgage approval. Here's why it matters:

- Affordability: A lower DTI means you have enough remaining income for a mortgage payment.

- Approval and Terms: Lenders use DTI to decide if you qualify and what rates/amounts to offer. Lower DTIs get better deals.

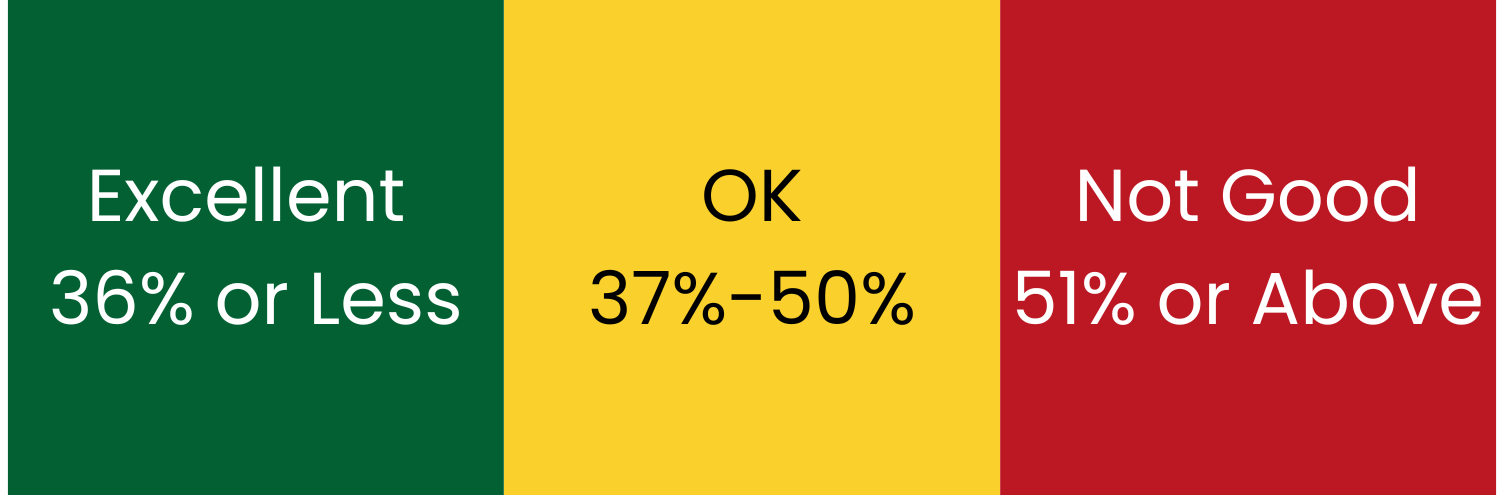

What is a Good DTI?

Tips on Improving your DTI

- Focus on paying off credit cards first - their high interest rates hurt your DTI the most.

- Contact your lenders - you may be able to get them to lower your interest rates, giving your DTI a break.

- Consider combining debts into a single loan with a lower rate. Less overall debt means less DTI drag.

- Get a side hustle or negotiate a raise - more income gives you a better DTI.

- Put more money down on a home upfront. A smaller mortgage results in a lower DTI.

Proven Debt Reduction Tactics

1. Debt Snowball/Avalanche

Use the debt snowball or debt avalanche methods to aggressively pay down high-interest debts. This can rapidly lower your total debt levels and improve your DTI over time.

2.Negotiate with Creditors

Reach out to your creditors and explain your situation. They may be willing to lower minimum payments, interest rates, or work with you on a payment plan to make your debts more manageable.

3.Increase Monthly Payments

Even small increases to your monthly payments on loans and credit cards can make a big difference in chipping away at your total debt load over time.

4.Explore Debt Consolidation

Combining multiple debts into one new loan with a lower interest rate can simplify payments and reduce your overall DTI.

ACM offers personalized loan solutions for different DTI needs. Contact Us today to explore your options.

Key Takeaways

- DTI matters: Lower DTI (debt vs income %) means you're a more attractive borrower.

- Sweet Spots: Aim for below 36% DTI for the best deals.

- Improve DTI: Employ proven debt reduction tactics like snowballing, negotiating, and consolidating to improve your debt-to-income ratio..

- Low DTI = Easier Approval & Better Rates!

FAQs

Q) How can I get a loan with a high debt-to-income ratio?

A) Look into government-backed loans, work with specialized lenders, use collateral, or enlist a co-signer. The key is to actively reduce your total debt to improve your DTI over time.

Q) Does being a cosigner affect your debt-to-income ratio?

A) Yes, when you cosign a loan, the full loan amount is counted towards your DTI, making it harder for you to qualify for new credit until the cosigned debt is paid off.

Q) Does leasing a car affect debt-to-income ratio?

A) Yes, the monthly lease payments are included in DTI calculations, so leasing a car can impact your ability to qualify for other credit just like an auto loan.

Loan to Value

The LTV ratio compares the loan amount to the value of what you're buying. A lower LTV, like 80% or less, shows you're contributing more of your own money, making it less risky for the lender.

A lower LTV, around 80% or less, is better for a few key reasons:

- Saves You Money - Lower LTV means lower interest rates, saving you money long-term.

- Reduces Risk - A smaller loan with easier payments makes default less likely for the lender.

- Avoids PMI - With a high LTV above 80%, you may have to pay extra private mortgage insurance. Lower LTV helps you avoid this cost.

What is a Good LTV?

High LTV Loans Might Be a Good Option If You...

- Can Move In Faster: A smaller down payment with a high LTV loan lets you become a homeowner quicker.

- Boast a Stellar Credit Score: Your strong credit history can help you qualify for a high LTV loan despite the increased risk for the lender.

- Are Budget-Savvy for Long-Term: You're comfortable with potentially higher monthly payments and have a plan to increase your down payment in the future to reduce costs.

- Feel Confident About Affordability: You're sure you can manage the ongoing financial obligations of a high LTV loan, including private mortgage insurance (PMI).

- Have Limited Loan Choices: Traditional loan options or government programs might not be suitable for your situation, making high LTV loans your best alternative.

Key Takeaways

- LTV: Loan vs. Down Payment: Low LTV means a bigger down payment (smaller loan).

- Formula: Loan amount divided by appraised value x 100%.

- Lower LTV is better: Saves money on interest, reduces risk, avoids PMI (extra insurance).

- Aim for 80% LTV or below to avoid PMI.

- High LTV options exist if: You have strong credit, can afford higher payments, plan to increase down payment later, have limited traditional loan options.

FAQS

Q) How to Calculate LTV Formula

A) LTV = (Loan Amount) / (Property Value) x 100%

For example, if the loan amount is $200,000 and the property value is $250,000, the LTV would be:

LTV = ($200,000) / ($250,000) x 100% = 80%

This 80% LTV shows the borrower is covering 20% of the property value with their own down payment.

Savings

Buying a house requires a good amount of money saved up, There's no one-size-fits-all answer to how much you should save before buying a house. The ideal amount depends on several factors, including:

- Down Payment Requirements: Conventional loans typically require a 20% down payment, while FHA loans allow for a minimum down payment of 3.5%.

- Closing Costs: Think of these as fees to finalize the loan, like taxes and paperwork stuff. They can be 2-5% of the house price.

- Moving Day Mayhem: Budget for movers, trucks, boxes, and maybe even a temporary stay between houses.

- Rainy Day Relief Fund: Life throws curveballs, so having 3-6 months of living expenses saved can be a lifesaver in case of unexpected costs.

- Your Financial Situation:

Consider your current debts, income stability, and overall financial goals.

Top Hacks: Saving for Your Dream Home

- Budget Ruthlessly: Track spending and cut back on non-essentials. Every dollar saved counts!

- Automate Savings: Set up automatic transfers to your down payment account. "Pay yourself first!"

- Boost Income: Hustle! Explore side gigs, freelance work, or negotiate a raise. More money, faster saving.

- Save Smarter: High-yield accounts or CDs can grow your savings. Just plan for withdrawal rules.

- Sell Your Stuff: Declutter and turn unused items into cash with online marketplaces or garage sales.

- Goal Getter: Set SMART goals for your down payment. Track progress to stay motivated.

- Dream Home Vision Board: Pictures and visualizations can fuel your saving fire!

- Down Payment Help Exists: Research government or local programs that can help with down payment costs.

Key Takeaways

- No one-size-fits-all: Down payment, closing costs, moving & emergency savings all play a role.

- Big Down Payment (20%) = Lower Costs: Smaller monthly payments and avoids PMI.

- Smaller Down Payment (3.5%) is Possible: Expect higher monthly payments with PMI, plus closing costs, moving & emergency savings.

- Save Smart & Save More:

- Budget & cut back.

- Automate savings.

- Boost income with side hustles.

- Explore high-yield accounts or CDs.

- Sell unused stuff to turn clutter into cash.

- Set SMART goals and track progress.

- Research down payment assistance programs.

FAQs

Q) Can you use multiple down payment assistance programs?

A) In many cases, you can combine multiple down payment assistance programs to reach the required amount for buying a home. However, the eligibility rules and maximum amounts can vary across different assistance options, so coordination with your lender is key.

Q) What down payment assistance programs are available in Texas?

A) Texas offers a variety of down payment assistance programs to help first-time and low-income homebuyers cover the upfront costs of purchasing a home. Some of the most widely available options in the state include:

- Texas Mortgage Credit Certificate Program - Provides a federal income tax credit to reduce the amount of taxes owed, freeing up funds for the down payment.

- Texas My First Texas Home - Offers loans with low fixed interest rates and down payment assistance grants of up to 5% of the home's purchase price.

- Texas Statewide Homebuyer Assistance Program - Provides forgivable second mortgages of up to 5% of the home's value to cover the down payment and closing costs.

- Local down payment assistance programs - Many cities and counties in Texas operate their own programs, often targeting specific demographics or income levels. Examples include the City of Houston's Home Safe Home program.

The specific eligibility requirements and assistance amounts can vary, so prospective Texas homebuyers should research the options in their local area to determine the best fit.

Conclusion

Owning a home is an exciting prospect, but it requires financial planning. By understanding your credit score, debt-to-income ratio, and loan-to-value ratio, you'll be well-equipped to navigate the mortgage process.

Take action before diving in: check your credit score, calculate your DTI, and start saving for a down payment. Explore down payment assistance programs if needed. Finally, compare loan options from different lenders to find the best fit for you.

Ready to make your dream home a reality? We can help! At ACM, we offer a variety of mortgage options for all credit scores and financial situations. Contact us today and let's discuss your homeownership goals. Together, we'll turn that dream into an address.

Related Links

List of Services

-

How Much of Your Income Should Go Towards a Mortgage Payment?Read More List Item 1

One of the most crucial factors to consider when buying a home is how much of your income should go towards your mortgage payment.

-

Consolidating Credit Card Debt into Your Mortgage: Is It a Good Idea?Read More List Item 2

If you're struggling with high-interest credit card debt, you may be wondering if consolidating it into your mortgage is a viable option.

-

How to calculate your mortgage paymentRead More List Item 3

Calculating your mortgage payment involves several factors, including the amount you borrow (the principal), the interest rate, the loan term (the length of time you have to repay the loan), and any additional fees or costs associated with the loan.

Austin Capital Mortgage

Serving Families Since 1996

We combine ethical lending practices, personalized service, and innovative solutions to redefine what it means to be a mortgage lender.

Contact Information

Phone

+1 512 891 0778

Email

loans@austincapitalmortgage.com

Address

3801 N Capital of Texas Hwy J-180, Austin, TX 78746, USA

2023 Austin Capital Mortgage, a division of Aspire Home Loan | All Rights Reserved | Member FDIC | NMLS 1955132 | Privacy Policy

“CONSUMERS WISHING TO FILE A COMPLAINT AGAINST A COMPANY OR A RESIDENTIAL MORTGAGE LOAN ORIGINATOR SHOULD COMPLETE AND SEND A COMPLAINT FORM TO THE TEXAS DEPARTMENT OF SAVINGS AND MORTGAGE LENDING, 2601 NORTH LAMAR, SUITE 201, AUSTIN, TEXAS 78705. COMPLAINT FORMS AND INSTRUCTIONS MAY BE OBTAINED FROM THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV. A TOLL-FREE CONSUMER HOTLINE IS AVAILABLE AT 1-877-276-5550. THE DEPARTMENT MAINTAINS A RECOVERY FUND TO MAKE PAYMENTS OF CERTAIN ACTUAL OUT OF POCKET DAMAGES SUSTAINED BY BORROWERS CAUSED BY ACTS OF LICENSED RESIDENTIAL MORTGAGE LOAN ORIGINATORS. A WRITTEN APPLICATION FOR REIMBURSEMENT FROM THE RECOVERY FUND MUST BE FILED WITH AND INVESTIGATED BY THE DEPARTMENT PRIOR TO THE PAYMENT OF A CLAIM. FOR MORE INFORMATION ABOUT THE RECOVERY FUND, PLEASE CONSULT THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV