FHA Loans for First-Time Home Buyers

Are you dreaming of owning your first home but feel overwhelmed by the process?

Our FHA loan solutions are designed with first-time home buyers like you in mind.

- Down Payment as low as 3.5%

- Low Credit Requirements & High DTI Ratio

- Lowest Interest Rates, No Commission

- Takes 2 mins to apply

TEXAS' TOP RATED MORTGAGE LENDERS SINCE 1996

FHA Loans for First Time Home Buyers

Stop Renting, Start Owning! Build Equity as a Homeowner.

Get your FHA pre-approval today and begin your homeownership journey with confidence!

- Soft credit pull: won't impact your credit score

- Takes 2 minutes to apply

$7B+

In Loans Funded

25+

Years of Excellence

10K+

Happy Families & Homeowners

25

Top Mortgage Lenders in Texas since 1996

Apply for an FHA Pre Approval & Get Pre-Approved Now

Let's turn that 'maybe' into a 'definitely'! Get pre-approved for an FHA loan in as less as 2 minutes.

A pre approval not only gives you the confidence to bid on your first home but also puts you in a great spot as a buyer. It only takes 2 mins to apply.

FHA Loans: Advantages for First Time Home Buyers

Easy eligibility, affordable terms, and fast preapproval - FHA loans are ideal for first time home buyers like you!

The maximum FHA loan limit in a high-cost county has increased to $1,149,825 in 2024. Read full FHA loan eligibility criteria for 2024 here.

Hear from Our Happy Homeowners: 100% Customer Satisfaction Rates

Average Rating: 5 Stars? Sounds too good to be true, right? But that's what makes us "us".

"Her advice locked in an interest rate that made my home affordable"

I can not say enough good things about Rachel Brown at Austin Capital Mortgage.

To say I wouldn't be a homeowner without her is not an exaggeration.

For two years Rachel has worked with me on finding, financing and closing on a home. Her advice locked in an interest rate that made my home affordable and her help with financing was invaluable.

This was a stressful process and her availability and vast knowledge made all the difference. I will always be grateful to her for her guidance and expertise in buying my home!

Racheal C.

"Austin Capital Mortgage just completed my refinance start-to-finish in 3 weeks!"

Austin Capital Mortgage just completed my refinance start-to-finish in 3 weeks!

Banks are overwhelmed with refinance applications and many folks can't even get approved for one, or if they do, it's taking 8 weeks or more.

I filled out the application, send my documents, and a couple weeks later answered an email about what time I wanted to close.

It was the easiest lending experience I have ever had. This is my third loan with them and I'm still surprised each time at how easy it is. Not only that, my rate was a half percent lower than Bankrate's average. I also liked that I'm helping a local business. I worked with Jeff, Adrienne, and Charlie and they are rock stars.

My refinance was small, especially in Austin terms, but they made me feel like their most important customer throughout the process.

I can't say it enough, Austin Capital Mortgage is the best Mortgage company in Austin.

P. J. Lang

"When you get the best price and the best service, using Charlie's team is a no-brainer."

Charlie and his team did an exceptional job helping me close on my first home loan. They offered the best rate/least points of the multiple lenders that provided me with quotes, including local credit unions. When you get the best price and the best service, using Charlie's team is a no-brainer.

Leslie was very conscious of my time and even pushed back on my behalf to minimize requests. She was very patient with me despite all the extra questions I had that come with being a first-time buyer.

Charlie went the extra mile to help solve an appraisal issue, for which I am extremely grateful. Even though it was my first time working with them, they treated me as if I was a long-time customer and truly cared about making sure I was satisfied.

I strongly recommend reaching out to Austin Capital Mortgage and getting a quote. It was probably the smartest thing I did when purchasing my first home.

Ben Cowles

"Closings usually takes months, but with Mr. Cruz’s help, we were able to have everything wrapped up in about a month."

We had a wonderful experience with Austin Capital Mortgage. Josh Cruz was our agent, and he worked tirelessly to make sure that we were on track to obtain our loan.

He even asked emergency questions for us on Christmas Eve!

We live in rural West Texas where closings usually takes months, but with Mr. Cruz’s help, we were able to have everything wrapped up in about a month.

Everything was so fast and easy because Josh worked so hard for us.

Kelly Havner

"She was able to get us a very low mortgage and was even able to adjust it within the lock in period when rates dropped even lower."

My husband and I were referred to Rachel Brown with Austin Capital Mortgage by our realtor, and we could not be more happy with the service she provided.

She was able to get us a very low mortgage and was even able to adjust it within the lock in period when rates dropped even lower.

We were first time homebuyers so throughout the process we had a lot of questions that Rachel was more than willing to provide the answers to in a very timely manner.

It was always great to know that when a pressing need arose Rachel was just a call away to help with us understand and take the appropriate action.

She even made the trip to be at our closing in Houston to be sure we understood all the documents during the process.

We would highly recommend Rachel and Austin Capital Mortgage to anyone looking for a new home or to refinance.

Andrea Bucher

"After going with 3 different banks, almost running out of time Austin Capital Mortgage were able to help me and required the least amount of down payment compared to the other 3 banks."

Where should I begin, Charlie and Adrienne are awesome! They were upfront with what I needed to provide in order to qualify for a Home loan. I was able to speak with one them whenever a concern came up.

After going with 3 different banks, almost running out of time Austin Capital Mortgage were able to help me and required the least amount of down payment compared to the other 3 banks. They made it possible to buy my home in time and not lose my earnest money.

I wish I would have found them first and would have avoided the hassle and stress caused by the other banks.

My advice to anyone who reads my review give them a try you might be in for a surprise when you realize how two great personnel like Charlie and Adrienne can make your loan process super easy.

Maricela Salas

FHA Home Loan Eligibility & Requirements

As with any other loan, you must meet the requirements to qualify for an FHA loan. Here's a look at the lending guidelines.

- If your FICO score is between 500 and 579, you'll need a 10% down payment, but if your FICO score is 580+, you're only required to put down 3.5%.

- You must have verifiable employment over the prior two-year period.

- Your income must be verifiable by federal tax returns, check stubs, or bank statements.

- The loan must finance your primary residence.

- The property must meet HUD (The United States Department of Housing and Urban Development) guidelines and be appraised by an FHA-approved appraiser.

- Your back-end debt ratio, which comprises mortgage and all monthly debts, must be less than 43% less of your gross monthly income. (Some lenders round this number up to 50%)

- Your front-end debt ratio, which comprises just mortgage loan payments, should be no higher than 31% of your gross monthly income.

- If you've filed for bankruptcy, you must wait between one and two years to apply for an FHA loan and three years after a foreclosure. Be sure to ask a lender because some may make exceptions to waiting periods if your circumstances are extenuating.

Today's FHA Loan Rates

ACM's FHA Duplex Loan

Ever thought about owning a duplex? With Austin Capital Mortgage’s FHA Duplex Loan, it's easier than you think.

Just 3.5% down gets you in, living in one unit, and the unit next door? It’s working for you, bringing in that sweet rental income.

It’s strategic, smart, and simple, and it can boost your buying power with loan limits up to $700,000.

Why Consider Getting a Duplex with ACM's FHA Duplex Loan?

- Jump in With Just 3.5% Down: Yes, that’s all it takes to get started.

- Boost Your Buying Power: That rental income could help you qualify for more.

- High Loan Limits: With loan limits going up to $700,000, your dream duplex isn’t far off.

Can you Afford the House You Want?

FHA Loan Calculator: Calculate Your Monthly Mortgage Payments

Just plug in the numbers and calculate your monthly mortgage payments, interest, taxes and total amount paid over time.

Estimate your FHA Loan payment:

Your Estimated

Monthly Payment:

- Principal & Interest

- Taxes

- Insurance

- Annual MIP

Loan Totals:

- Purchase Price

- Down Payment

- Upfront MIP

- Total Loan Amount

Estimated Taxes & Insurance: Property taxes are generally estimated to be 1.2% of the home's value, but may vary based on your location. Annual homeowners insurance is roughly 0.35% of the home's value but can change based on insurer. Your loan specialist can help you determine property tax and insurance rates in your area.

Annual MIP The Annual MIP ranges from 0.45% to 1.05% depending on loan term, loan amount and down payment. However, for most FHA borrowers, the Annual MIP is 0.85% of the loan amount. The Annual MIP can last for the life of the loan, or be removed after 11 years if the original down payment is 10% or more.

Upfront MIP The Upfront MIP, sometimes referred to as the FHA funding fee, is 1.75% of the loan amount. This fee is due at closing and is typically financed into the entire loan amount to reduce out of pocket costs.

Amount Financed Purchase Price (-) Down Payment (+) Upfront MIP

The ACM Advantage: Mortgages that Adapt to Your Lifestyle

We say 'Yes' when others say 'No'. At Austin Capital Mortgage, we believe that your mortgage should adapt to your lifestyle, not the other way around.

Redefining Mortgage Industry Standards

Austin Capital Mortgage has been ranked as one of the Top Mortgage Lenders in Texas, every year since 1996 by the Austin Business Journal.

5 Stars: The Only Way We Know How to Serve

We have an Average User Rating of 5 Stars across Google, Yelp, Zillow, and Facebook, and we've been operating since 1996.

Flexible Credit Requirements

Think you have less that perfect credit score? We offer diverse loan options with flexible credit requirements, while helping you rebuild your credit score.

Personalized Mortgage Solutions

Hefty mortgage payments stopping you from owning your dream home? Our mortgage plans are customized to fit your financial needs, and lower your monthly payments.

Since 1996, the Austin Business Journal has consistently ranked Austin Capital Mortgage among the top mortgage lenders in Texas.

Our Streamlined Mortgage Approval Process

At Austin Capital Mortgage, we've streamlined our approach to make your journey to homeownership, refinancing, or accessing equity as smooth and stress-free as possible.

Understanding Your Needs

Begin your journey with our pre-approval where we assess your financial readiness, giving you a clear picture of your borrowing potential for an FHA loan.

Expert Guidance

Our experts provide insights into various loan options and processes, ensuring you have all the necessary information to make informed decisions.

Choosing the Right Loan

Based on your needs and financial situation, we help you select the most suitable loan option.

Application Process

We guide you through the application process, assisting with paperwork and necessary documentation, tailored to the nuances of 1099 income earners.

Detailed Verification

Our team meticulously processes your application, verifying all the details and documentation.

Regular Updates

You'll receive regular updates on the status of your loan application, ensuring transparency and clarity throughout the process.

Thorough Review

In this stage, our underwriters review your application in detail, assessing risk and ensuring all criteria are met.

Transparent Communication

We maintain open lines of communication, addressing any queries from the underwriting team and coordinating any additional information they may require.

Loan Approval

Once your loan is approved, we'll discuss the final terms and prepare for closing.

Closing Process

We'll schedule and facilitate the closing process, ensuring a smooth and hassle-free finalization of your loan.

Continued Assistance

Even after closing, our team is here to provide ongoing support and answer any questions you might have.

Future Financial Planning

We’re committed to building long-term relationships and are available to assist with any future financial needs or mortgage-related questions.

Pre-Approval

Your First Step Towards Homeownership

Begin your journey with our pre-approval where we assess your financial readiness, giving you a clear picture of your borrowing potential for an FHA loan.

Loan Application

Streamlined & Hassle Free Application

We’ll help you gather and submit all necessary documentation, making the process straightforward and stress-free. We ensure protection of personal data.

Property Appraisal

Your Future Home Valuation

We arrange for an FHA-compliant appraisal to ensure the property you're eyeing meets both value and safety standards, protecting your investment.

Underwriting

Our Commitment to Responsible Lending

We meticulously review your application, upholding our commitment to ethical lending, ensuring everything aligns with FHA guidelines.

Loan Approval

Saying 'Yes' to Your Homeownership Dream

Once approved, we share the good news along with clear details of your loan terms, staying true to our promise of clear and honest communication.

Closing

Congratulations are in order!

At closing, we celebrate this significant milestone with you, ensuring a smooth signing process and clarifying any last-minute queries.

Post-Closing

On-going Support for Your Long-Term Goals

With the loan finalized, the journey doesn’t end. We remain your trusted partners, ready to assist as you embark on this exciting new chapter.

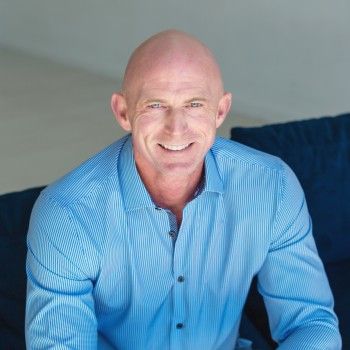

25 Years of Excellence: Meet Our Team

From our experienced loan advisors to our super-supportive staff, we've got a crew that really gets the ins and outs of first time home buyers mortgage needs.

Frequently Asked Questions

We are here to clear up any confusion and guide you on your path to homeownership or refinancing. Here are some of the most common questions we get, with a quick way to connect with our mortgage advisors for more detailed answers.

-

What is an FHA loan?

An FHA loan is a mortgage insured by the Federal Housing Administration, designed for lower down payments and less stringent credit requirements, making it a popular choice for first-time home buyers.

-

How much down payment do I need for an FHA loan?

FHA loans typically require a minimum down payment of 3.5% if your credit score is 580 or higher.

Let's discuss how your unique income can work towards securing your mortgage.

-

Can first-time home buyers get better rates with FHA loans?

FHA loans offer competitive interest rates, which can be particularly advantageous for first-time buyers with less established credit.

Reach out to us to discuss how we can work with your unique financial history.

-

What are the credit score requirements for an FHA loan?

The minimum credit score for an FHA loan is usually 580 for a 3.5% down payment. Scores between 500 and 579 may require a 10% down payment.

Have less than perfect credit score? Don't worry! Our mortgage experts will help you improve your credit score before applying. Talk to an expert now.

-

Are there any income limits for FHA loans?

No, FHA loans do not have specified income limits, but borrowers must have a debt-to-income ratio within acceptable limits to qualify.

-

How to apply for an FHA Pre Approval?

Apply for an FHA pre approval in as little as 2 minutes. Just fill this quick form, and our experts will get in touch with you to get you pre-approved and fast-track your loan application.

-

Can I use an FHA loan to buy any type of home?

FHA loans can be used to purchase single-family homes, 2-4 unit properties, condos, and manufactured homes that meet FHA guidelines.

Let's discuss the best loan options for you.

-

What are the closing costs for an FHA loan?

Closing costs vary but typically range from 2% to 6% of the purchase price. FHA allows sellers, builders, or lenders to cover part of these costs.

Let's discuss the best mortgage strategy for you.

-

How can I improve my chances of getting approved for a mortgage?

Improving your credit score, reducing debts, and increasing your down payment can all help. Keeping your financial documents organized and up-to-date is also crucial.

We can provide personalized tips based on your financial situation. Speak to an Advisor.

-

Can FHA loans be refinanced?

Yes, FHA loans can be refinanced to another FHA loan, often with streamlined paperwork and without a new appraisal.

-

What are the benefits of an FHA loan for first-time buyers?

Start by getting pre-approved by a lender who offers FHA loans to understand how much you can borrow.

Have questions or feedback? Reach out to our support team at:

Or give us a call at:

2023 Austin Capital Mortgage, a division of Aspire Home Loan | All Rights Reserved | Member FDIC | NMLS 1955132 | Privacy Policy

“CONSUMERS WISHING TO FILE A COMPLAINT AGAINST A COMPANY OR A RESIDENTIAL MORTGAGE LOAN ORIGINATOR SHOULD COMPLETE AND SEND A COMPLAINT FORM TO THE TEXAS DEPARTMENT OF SAVINGS AND MORTGAGE LENDING, 2601 NORTH LAMAR, SUITE 201, AUSTIN, TEXAS 78705. COMPLAINT FORMS AND INSTRUCTIONS MAY BE OBTAINED FROM THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV. A TOLL-FREE CONSUMER HOTLINE IS AVAILABLE AT 1-877-276-5550. THE DEPARTMENT MAINTAINS A RECOVERY FUND TO MAKE PAYMENTS OF CERTAIN ACTUAL OUT OF POCKET DAMAGES SUSTAINED BY BORROWERS CAUSED BY ACTS OF LICENSED RESIDENTIAL MORTGAGE LOAN ORIGINATORS. A WRITTEN APPLICATION FOR REIMBURSEMENT FROM THE RECOVERY FUND MUST BE FILED WITH AND INVESTIGATED BY THE DEPARTMENT PRIOR TO THE PAYMENT OF A CLAIM. FOR MORE INFORMATION ABOUT THE RECOVERY FUND, PLEASE CONSULT THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV